NOTE: This is the piece I had planned to run yesterday, before I got sidetracked by fascinating and very relevant financial information (yes, that’s not a contradiction in terms!) about the Trenton Water Works. There is further info on that, below. But first:

Thursday, Trenton’s City Council is scheduled – at what will be the final session for this Council and the Eric Jackson Administration – to deliberate the Second Reading of a number of Bond Ordinances which, if all are passed, will increase the long-term debt obligations of the Trenton Water Works by $18.7 Million Dollars, and that of the City of Trenton by $7.3 Million Dollars. These Ordinances were easily passed First Reading on June 5; there’s no reason to believe that this Council won’t give their final, lame-duck approvals on Thursday.

We don’t know any more about the capital projects being funded by these Ordinances; no one in the City or on Council has responded to my questions, or replied to my comments made at the June 5 meeting. But we do know a little more about the overall debt burden that the City and its associated utilities is carrying.

Since the City will be discussing the Trenton Water Works twice this week, tomorrow at an open public forum at City Hall and in a presentation at Thursday’s Council meeting, I thought this it would be timely to discuss these items today, in the hope that some of you readers might be able to ask a pointed question or two at these sessions.

Each year, every municipality in the State of New Jersey files a number of forms with the Office of Local Government Services of the Department of Community Affairs (DCA). These forms provide the State with snapshot pictures of the financial status (I was going to use the word “health,” here, but hey! it’s Trenton we’re talking about, the Sick Man of Mercer County. “Status” it is). These forms are all available for public examination and review, here. One of these forms is called the Annual Debt Statement and Debt Limit Calculation. It’s an Excel spreadsheet that summarizes the debt load of the municipality by each Fiscal Year ending on June 30. It also provides a great detail in separate tabs. The DCA website contains the Trenton forms for the recent Fiscal Years of 2013, 2014, and 2015 (The links will take you directly to copies downloaded from the State website). The two most recent filings, for 2016 and 2017, aren’t on the State website. The City of Trenton released those (those have been uploaded as well) to me in response to an Open Public Records Act (OPRA) request. These forms give us a pretty good look at the overall debt of the City.

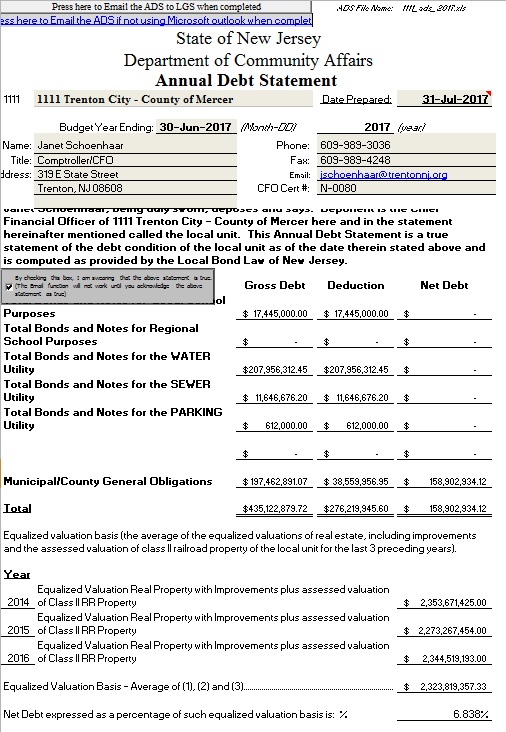

First, here’s a look at the front page of the most recently prepared Debt Statement, the one dated July 31, 2017 for the budget year than ended June 30 of that year. What does it tell us?

Let’s start with the end. As the Bond Counsel for the City of Trenton, Everett Johnson, explained to City Council on June 5, in New Jersey the statutory maximum debt to be carried by a municipality is supposed to be 3.5% of the total Net Taxable Valuation of a municipality’s total taxable property. It is assumed by the State of NJ that carrying debt above that 3.5% threshold will jeopardize a town’s finances, as more tax revenue goes toward long-term debt service, leaving less available to pay for more current expenses, such as payroll.

We see above that Trenton’s Net Debt is 6.838%, almost double what the State allows and considers a “safe” amount of debt. Mr. Johnson said on June 5 that Trenton has for decades exceeded the statutory limit, because so much of Trenton’s real estate is property tax-exempt. That’s certainly been true for the five years of data we look at today.

In 2013, Trenton’s debt load was 5.902%. In 2014, 6.476%. 2015’s number was 6.855%. And in 2016, the number was 6.360%.

One other very important statistic to take from these forms: On the 2013 form, the three-year average of Trenton’s total taxable property was calculated to be $2,739,777, 815. That total had declined to $2,323,819,357 by 2017. That is a drop in Trenton’s property value over just four years of $415,958,458, or 18%.

To repeat: Trenton’s property value has declined $415 Million Dollars from 2013 to 2017. With a declining tax base, that means there is less revenue that the City can raise for its own operating budget. It also means that every additional long-term debt obligation that the City floats to borrow money will drive that debt-to-valuation ratio ever higher.

And, lest we forget, the City’s shrinking value of taxable property means that commercial property owners and homeowners who already took a beating in last year’s revaluation will feel increasing heat and pressure applied by city government anxious to squeeze as much revenue out of what still has value as they can.

On June 5, I reminded Council that,

At the time of the last issuance of $40.6 Million in General Obligation Bonds, in November of last year, Moody’s bond rating service noted the City of Trenton’s low underlying rating of Baa1, and stated “The rating further reflects the city’s very high fixed costs, and outsized debt burden while also incorporating improved finances.”

Council members, the City was criticized for its “outsized debt burden” in November. Tonight you seek to increase that burden by nearly $27 Million Dollars. What will this do to the City’s underlying ratings, and how will that ripple through to likely large increases to the City’s costs of borrowing?

The Bond Ordinances that Council will likely approve on Thursday will only increase our “outsized debt burden.” By itself, the $7.3 Million general City Bond Ordinance will boost the Net Debt percentage from 6.838 to 7.152%. And that’s even before figuring in any more reductions to Trenton’s property values over the last year.

Trenton’s finances are going in the wrong direction.

One other note on Trenton’s debt, before moving to the Water Works.

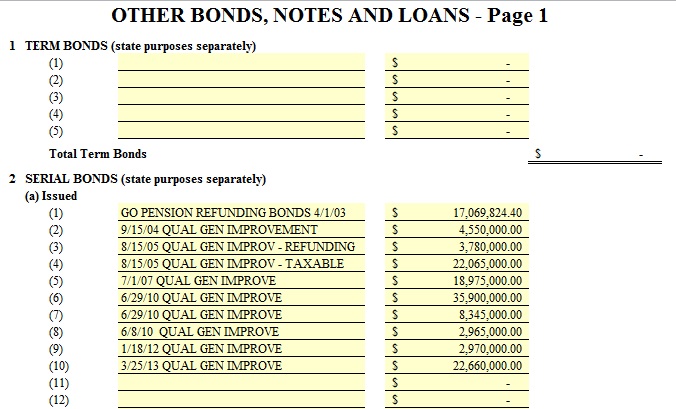

On the tab in the 2017 report labeled “muni bonds issued,” there is a list of the current bond issues which the city is currently servicing:

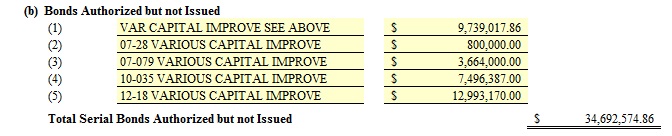

These different issues total out to $139,279,824. Right below that is a list titled, “Bonds Authorized but not Issued” [Emphasis mine – KM].

This list totals $34,692,575. Seeing this list leads to a number of questions, which I hope someone will ask of Council and the Administration on Thursday (I won’t be able to attend). Such as,

This list totals $34,692,575. Seeing this list leads to a number of questions, which I hope someone will ask of Council and the Administration on Thursday (I won’t be able to attend). Such as,

- If there is previously-authorized authority to issue another $35 Million in bonds, why is there a new request for $7.3 Million?

- Some of these bond authorizations seem to be several years old, with numbers suggesting 2007 and 2010 for some of them. If these bonds have never been issued, should they be canceled? Will doing so improve the city’s bond ratings?

- And finally, the same question I asked on June 5: Are all of these proposed projects and expenses, to be paid for with this new borrowing, really necessary right now? Why not hold off until the new Council and Administration can review them?

- In other words, and to cut to the chase: What’s the rush???

— # —

Now, an update to the Water Works. Yesterday, I posted links to five years’ (Fiscal Years ending June 30 for 2013 through 2017) worth of Debt Statements prepared by the City and submitted to the NJ Department of Community Affairs. In each of these Statements, in the form of Excel Spreadsheets, there are tabs providing summary financial information about other City entities that incur debt obligations under their own authority, such as Trenton Public Schools, the Sewer Utility, and the Trenton Water Works (TWW). These statements indicate that, far from being nearly insolvent – the impression given by the fact that the utility has for decades scrimped and starved the utility of needed manpower, maintenance, and capital investment – the water utility serving nearly a quarter million Mercer County residents in the City and outside has consistently earned substantial annual surpluses. By one simplistic measure, TWW outperforms some of America’s most profitable corporations, such as Apple, Google, and JP Morgan/Chase.

I thought that was amazing information, and posted it. Alert reader Iana Dikidjieva posted a comment on Facebook in which she said, “I always just read the audits.”

Well! Dang! In yet another of the nooks and crannies of the Trenton City website, a dozen years worth of financial reports and financial statements as reviewed and vetted by the city’s outside independent auditor Mercadien are posted for all the world to see. As I said yesterday, who knew? Not me, certainly! Thanks, Iana!

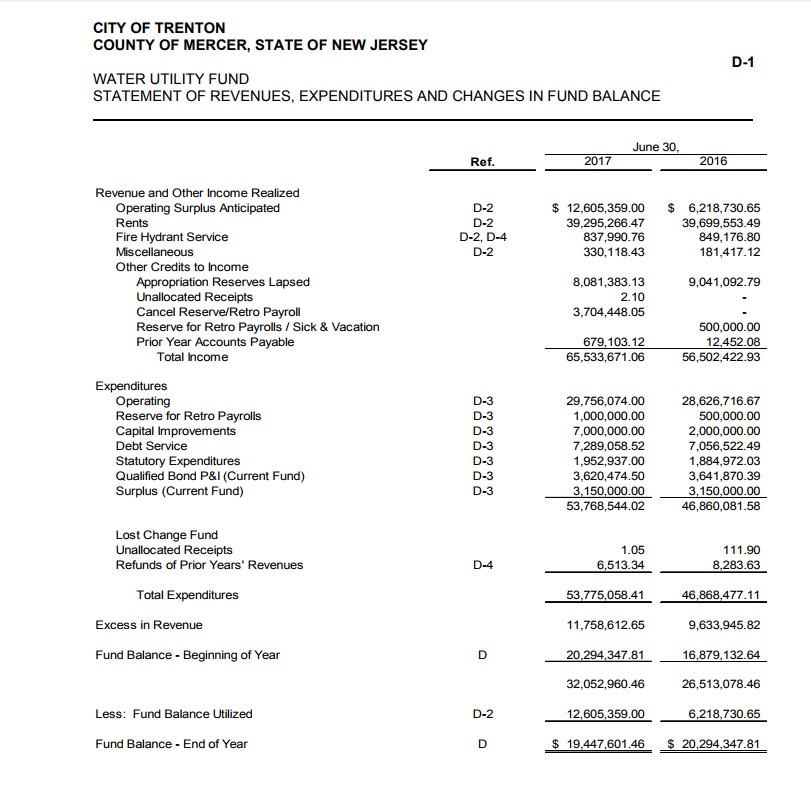

In this excerpt (page 99) of the 2017 Audited statements, you can see an Income Statement for the Water Utility, with much more detailed information than contained in the annual DCA Debt Statements I looked at yesterday. The format is different, and the date of the audit report – December 29, 2017 – is five months later than the Debt Statement’s July 31 date. It also reflects any post-Debt Statement adjustments made by the City or its auditors.

Yesterday, I stated that “The operating surplus – some might call it the “profit” for the Water Works – was $15,345,040. The operating margin (surplus as a percentage of total income) was 28.3%.” On this audited statement, the “Excess in Revenue” for the fiscal year ended June 30, 2017 is stated as $11,758,613. That’s about $3.6 Million lower than included on the July 31 Debt Statement. However, as a percentage of the annual revenue TWW earned (which I use as the “Total Income” figure of $65,533,671, less the “Operating Surplus Anticipated” line at the top of $12,605,359; that’s not actual customer billing or other revenue), the net margin for the Water Works with these numbers is 17.9%. Looking at the numbers for the 2016 fiscal year, appearing right alongside, the net margin is 19.2%.

Those are not the stratospheric percentages I calculated yesterday. but still a mark of impressive financial performance by a utility that hasn’t provided nearly the same level of customer service and water safety! Even with a lower net margin, it is clear that the Trenton Water Works – from its own annual operating resources – can legitimately afford to spend more on hiring needed personnel, paying competitive salaries, and boost operating repairs and preventive maintenance.

This cache of Audited Financial Statements for a dozen years is bound to reveal other nuggets of useful information. I thank Iana Dikidjieva for pointing me to it.

I will finish by saying that it would have been nice these last couple of months, going back to the February 1 City Council meeting when I criticized Council and Public Works Director Merkle Cherry for not having TWW financial statements available at what was supposed to be a comprehensive presentation on the condition of the Water Works, had someone said, “You know, we have the last dozen years of that data, audited too, on the City’s Website!” That would have been very useful and relevant information to have.

But, no one did. Perhaps Director Cherry nor anyone on Council didn’t know those reports were there?

If so, that’s another good reason I won’t be sorry to see so many of them leave in ten days.