I meant to post this yesterday, before the news of the property tax revaluations broke. I’ll get to it in a minute. Bear with me for a bit.

Regarding yesterday’s piece on the tax valuations, I want to state again how the figures on the spreadsheet made available by Appraisal Systems, Inc (ASI) should be interpreted at this point. For those folks who commented, on Facebook or via email, that valuation increases on individual properties by themselves don’t mean much until the new property tax rates are set. That’s true as far as it goes. We don’t know what new property tax rates are likely to be.

But, we do know that rates can’t change a great deal, given both the data that was released over the last few days, and what we know of the economic condition of Trenton over the last 25 years.

The total base of tax able property in the City of Trenton has not appreciably changed since the last property valuation in 1992. It is essentially flat. I explained yesterday that, for the sample of nearly 10,000 properties on the spreadsheet (out of approximately 30,000 parcels in the City) values not adjusted for inflation increased only 4.4% over the last 25 years. I felt comfortable in using that yesterday as a representative sample.

This trend has been citywide over the last decades, and can be confirmed in the State of New Jersey’s data on municipalities, found on this page. With this data (which does only go back to 1998, not 1992, but the trend is still consistently flat, flat, flat), we can see that the total tax base (called “Net Valuation Taxable” in the State’s data tables), increased 5.5% from 1998 to 2015. Pretty damned close to the 4.4% in yesterday’s sample.

Let’s wrap this up then. The city’s tax base is flat, after 25 years. The valuation of about half the city’s properties has gone, in some areas significantly. The city will therefore have to seek MORE money from those whose property valuation has gone up, in order to raise the same amount of taxes to pay for a City Budget that doesn’t change just because of this tax re-valuation. That’s what will happen.

It’s almost a Newtonian law of taxation for Trenton: with a flat tax base, property valuation actions downward in some neighborhoods will have offsetting valuation reactions upward in other neighborhoods in order to raise the same amount of taxes. Those whose properties are being re-valued at rates 40%, 50% and higher than their current values will have the honor of paying higher tax bills of 40%, 50% and more.

We don’t yet know the actual new tax rate, yes. With a flat tax base, as well as pretty consistent city budget and state financial support number, the rate has really not much room for change one way or the other. Even without a new tax rate, we can confidently conclude that the property owners who will receive these massive increased re-evaluations we see on the ASI spreadsheet will – if they continue to stand – later receive property tax bills from the City that will reflect their City tax bill increasing by about the same rate.

OK?

— # —

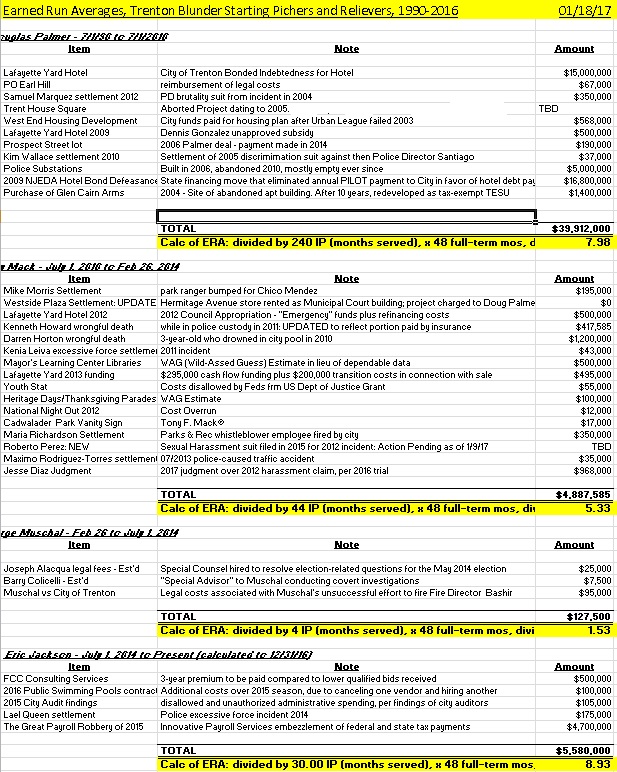

Now. As I was saying, I meant to talk about this yesterday. A couple of news headlines over the last few days have led to updates to the Earned Run Averages of our recent and current mayors. And, I think it’s fair to add two more “pitchers” to the rotation of our home team, what I call The Trenton Blunder.

The City of Trenton has been ordered to pay $968,000 in the resolution of the harassment suit brought against the City by former city firefighter Jesse Diaz. We award that run to former mayor Tony Mack, which raises his ERA to 5.33.

I have added some numbers to calculate an average for reliever George Muschal, who served as acting mayor for a little over 4 months in 2014. A couple of the numbers are estimates, at least for now. Attorney Joseph Alacqua was hired as a special counsel to help unravel the mess caused by City Clerk Richard Kachmar concerning the May 2014 city elections. Barry Collicelli was hired by Mr. Muschal as a covert investigator looking up dirt on some city Directors. I guesstimate those costs. We do know that the City spent $95,000 on legal costs associated with Muschal’s unsuccessful effort to dismiss the city’s Fire Director Qareeb Bashir in April 2014.

George Muschal certainly had a busy and entertaining four months in office. But at this point, the monetary damages he caused are not that substantial, compared to his other mayoral brethren. For now, I calculate his ERA at 1.53.

And this article, reminding us that former Mayor (1990-2010) Doug Palmer somehow believes he is still relevant in politics. And not just locally, but nationally. Mr. Palmer – who apparently is still hoping for a job in the Hillary Clinton Administration – has endorsed former Labor Secretary Tom Perez in his run for Chair of the Democratic National Committee. How lucky for Mr. Perez, to snag such a valuable and distinguished endorsement. Good Luck to him.

Anyway, this story got me thinking that Mr. Palmer’s record is worth a look, and some stats. And so, Douglas Palmer debuts here on the ERA list with a hefty 7.98.

Palmer’s high average is largely attributable to his record of big projects, with mostly negative results.

First and foremost, The Hotel. The City originally bonded $15,000,000. On top of that, during Palmer’s term, the State of NJ took over, in a process called “defeasance” annual payments in lieu of taxes that the City had been receiving for its budget on a property worth $16,800,000, in order to make hotel debt payments. One of the City’s Business Administrator, Dennis Gonzalez, slipped an unauthorized $500,000 to the Hotel as an illegal additional subsidy.

Yeah, The Hotel by itself really boosts Palmer’s stats. But there are more hits, runs and errors to charge to him.

Two police substations, built without need at $5,000,000 and all but abandoned. $1,400,000 to buy the wreck of the Glen Cairn Arms, which lay dormant until Thomas Edison State U took it off our hands for a song. Massive payments, so far TBD for my stats, for an aborted Trent House Square development project on a state Department of Justice parking lot. And a couple of other miscellaneous settlements and legal fees for good measure.

Welcome Doug Palmer to the rotation! An average of 7.98 over a 20-year career is nothing to be proud of. We are still, as a City, paying for Doug Palmer’s mistakes.

After these additions and updates, of the four pitchers I am following, the leader is still the current guy on the mound, Eric Jackson. 8.93 over only 2 1/2 years is very problematic. He still has some time to improve his numbers, I suppose. But he is still on the mound telling us, “I feel good! I’m getting in my groove!” He’s still never owned up to the Great Payroll Robbery, and never showed us that he’d shuffled up his team in its aftermath.

With headlines such as today’s “Crime was up in Trenton last year, led by 40 percent jump in shootings,” we see that he’s still loading the bases with no outs.

For now, here are the stats.

Kevin,

With regards to the assessment. The “Trenton 2017 Revaluation Tax Impact” pdf file on the Appraisal Systems site seems to indicate that the total assessed value (without exemptions)in the COT has actually gone up 22% from 2016-2017, therefore, all things being equal, the tax rate should drop an equivalent amount. Are these just rosy projections without much basis in fact or are we actually looking at a drop in rate if the total budgeted tax stays the same?

Thanks, Paul – That doc is based on Commercial Valuation in the City going up by almost double, from $546 Million to $927 Million.

I find that hard to believe, and will reserve judgment until those appeals have taken place. I can’t imagine commercial property owners will sit still for such a rosy assessment of the value of their property.

Plus, I will also guess that a lot of commercial property, such as The Hotel, which is currently assessed at a value of nearly $34 Million, is either not actually producing tax revenue, or is very, delinquent.

This is the most recent reporting on the Hotel that I’ve seen:

“The owners of the capital city’s only hotel have six months to pony up nearly $1 million owed in back taxes or face a possible foreclosure.” – http://www.trentonian.com/article/TT/20160826/NEWS/160829812